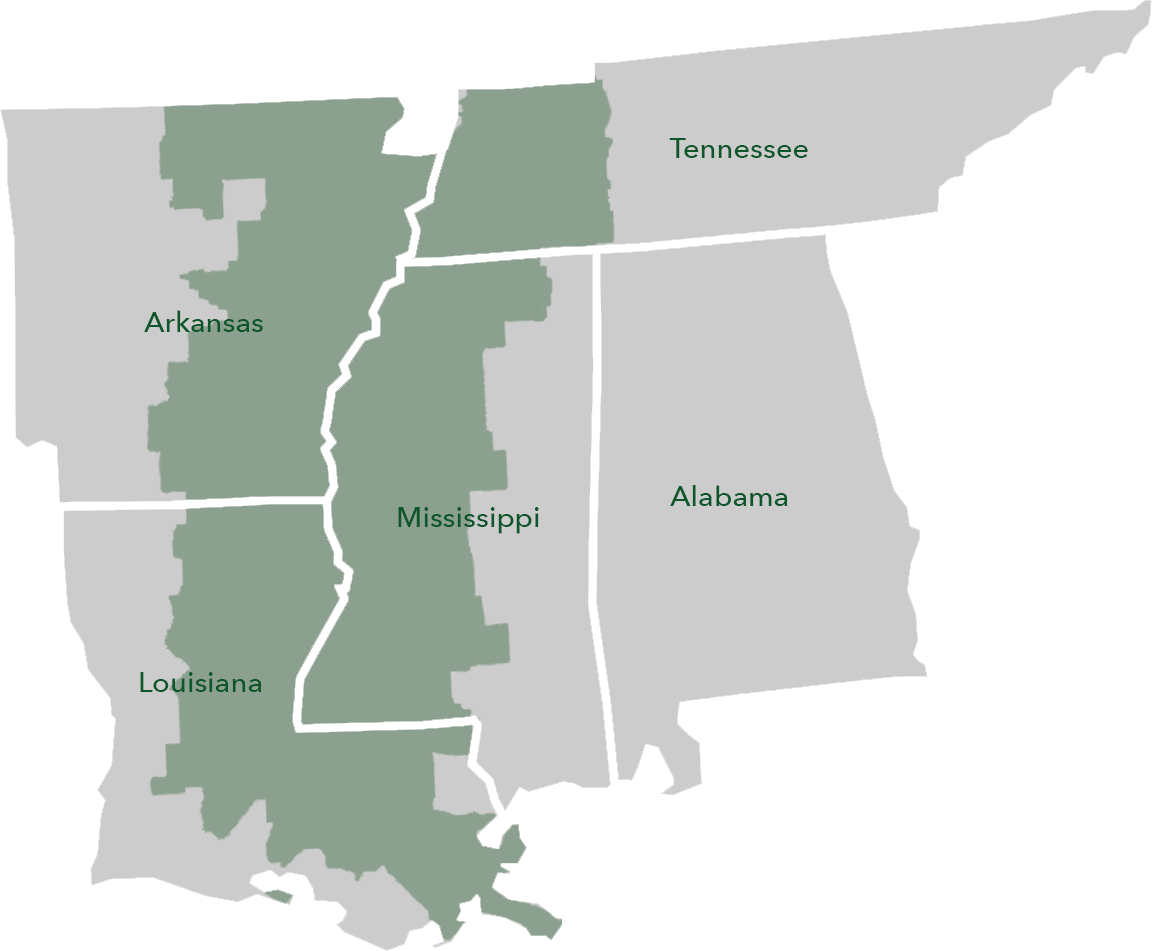

Culleywood Capital was founded in 2017 to address the community development needs of the Greater Mississippi Delta (“GMD”), including Mississippi, Arkansas, Louisiana, and Tennessee. Culleywood initially focused on supporting small and startup affordable housing developers serving the region, but over time, Culleywood expanded to include lending to small businesses, community facilities, and housing in response to needs identified in GMD communities.

Culleywood became certified as a CDFI in 2021, and in 2022, Culleywood acquired MuniStrategies, the largest CDE in Mississippi with over $370MM in NMTC allocation deployed. Since that time, Culleywood has received multiple CDFI Financial Assistance Awards, a Capital Magnet Fund Award, multiple New Markets Tax Credits allocations, and multiple special purpose Federal and State awards. We have also partnered with multiple community banks to expand our lending capacity, helping our partner banks meet CRA goals and pursue BEA Awards from US Treasury.

Throughout our growth, we have stayed committed to efficiently serving our clients and communities as place-based investors that live in the community and desire its long-term success. We provide custom financing solutions when traditional sources of capital are unable to meet the individual needs of the business or project.

Our community is region rich in culture and human capital yet is consistently ranked among the most distressed regions of the US. As a placed-based finance company, our team members live and work in the communities they serve, which helps us better understand and support the needs of businesses in our communities.

Community Development Financial Institutions (CDFIs) are lenders and investors with a mission to provide fair, responsible financing to rural, urban, Native, and other communities that mainstream finance doesn’t traditionally reach.

Unlike traditional banks, we specialize in lending to organizations and businesses in under-resourced communities, offering clients access to capital and financial services that increase economic potential and help build wealth.

The New Markets Tax Credit Program (NMTC Program) helps economically distressed communities attract private capital through federal tax credits. Investments made through the NMTC Program are used to finance businesses, breathing new life into underserved low-income communities.

MuniStrategies is a Community Development Entity and affiliate of Culleywood. MuniStrategies was formed in 2006 with a single goal – to help improve and strengthen the communities in the southeast through providing innovative financing to projects in advanced manufacturing, agri-business, healthcare and workforce development. Since inception, MuniStrategies has received and deployed allocations of New Markets Tax Credits from the CDFI Fund totaling more than $350 million and resulting in the creation of over 9,000 jobs.